Good news if you’ve been thinking about a modular or prefabricated hom! Getting finance is now much more achievable.

Commonwealth Bank has also recently stepped up too to support the prefab housing sector joining the growing list of banks willing to finance these types of dwellings.

With new funding options available, you can now borrow up to 80% for fixed-price prefab builds from approved providers. Even if your builder isn’t on the list, there are still financing options for up to 60%. This is a major improvement compared to what was possible just a few years ago.

Why Choose Prefabricated Homes

1. Faster Construction Times

Traditional home builds can take over a year to complete, but prefab homes can be ready in as little as 10 to 16 weeks. With construction happening off-site and installation handled efficiently, you can move into your dream home months sooner.

2. Greater Afoordability

Prefab homes are typically more cost-effective due to reduced labour and material waste. Combined with competitive prefab home loan options, buyers can save both time and money while securing long-term financial stability.

3. Sustainability and Quality

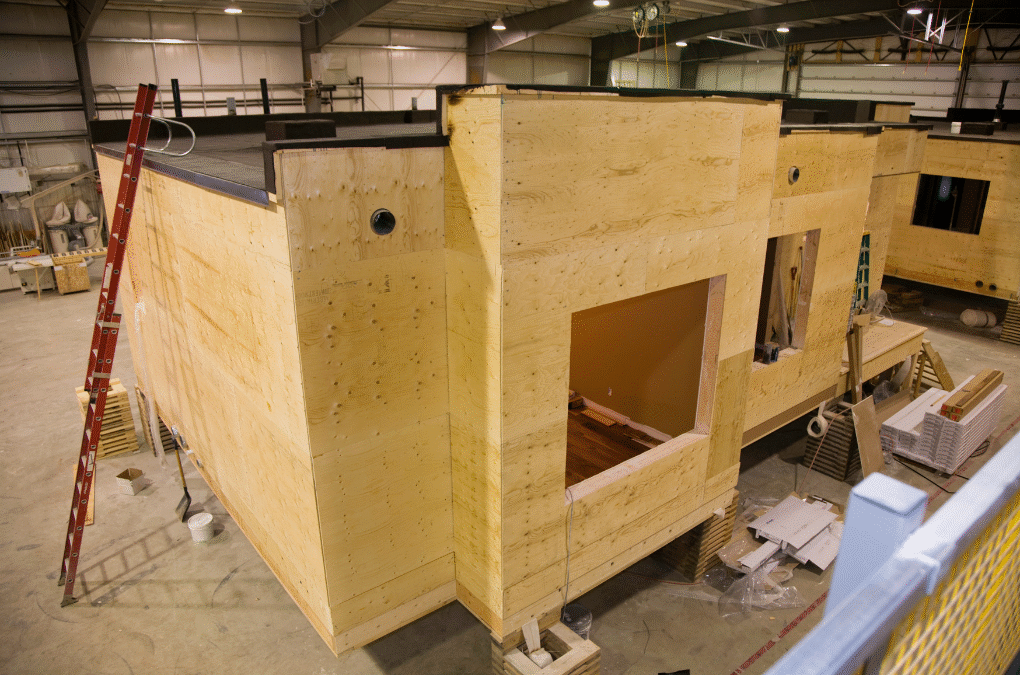

Prefabricated homes are often built in controlled environments, which leads to higher quality standards and less environmental impact. This makes them a smart choice for eco-conscious buyers looking for a modern, efficient living solution.

Rise of Prefab Homes loans in Australia

The growing interest in prefab and modular housing has prompted more banks and lenders — including the Commonwealth Bank — to adapt their lending policies.

Now, with prefab home loans offering up to 80% borrowing capacity for fixed-price builds, homeowners and investors alike can confidently enter the market.

This shift signals a major change in the housing finance landscape. As more lenders get on board, we expect prefab home loans to become a mainstream option across Australia, helping to address the country’s housing shortage while promoting more sustainable construction methods.

Thinking About Building or Investing in a Prefab Home?

Don’t wait to make your dream home a reality. Prefab home loans are transforming the way Australians build offering flexibility, speed, and affordability.

We can help you explore your prefab home loan options, and guide you through the process step-by-step.

Contact us today to start your journey toward a smarter, faster, and more affordable home build.

Phone: 1300 855 022

Email: clientservices@zippyfinancial.com.au

Zippy Financial is an award-winning mortgage brokerage specialising in home loans, property investment, commercial lending, and vehicle & asset finance. Whether you are looking to buy your first home, refinance or build your property investment portfolio, the team at Zippy Financial can help find and secure the right loan for you and your business.

About the Author:

Louisa Sanghera is an award-winning mortgage broker and Director at Zippy Financial. Louisa founded Zippy Financial with the goal of helping clients grow their wealth through smart property and business financing. Louisa utilises her expert financial knowledge, vision for exceptional customer service and passion for property to help her clients achieve their lifestyle and financial goals. Louisa is an experienced speaker, financial commentator, mortgage broker industry representative and small business advocate.

Connect with Louisa on Linkedin.

Louisa Sanghera is a Credit Representative (437236) of Mortgage Specialists Pty Ltd (Australian Credit Licence No. 387025).

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.