by Joy | Sep 17, 2025 | Blog

If you’re a first home buyer dreaming of owning your own home but struggling to save for a hefty 20% deposit, the Home Guarantee Scheme could be your game-changer. Thanks to this government-backed initiative, eligible buyers can now purchase a home with as little as a...

by Joy | Sep 12, 2025 | Blog

Buying your first home is becoming more accessible. Starting October 2025, key updates to Australia’s Home Guarantee Scheme will make it easier and more affordable to enter the property market—even if you don’t have a 20% deposit saved. While not a traditional grant,...

by Joy | Sep 11, 2025 | Blog

Spring has always been the busiest time in the property market and with three rate cuts in 2025, this home-buying season could be one of the most competitive yet. If you want to secure your dream property, finding your competitive edge in home buying is crucial. The...

by Joy | Sep 7, 2025 | Blog

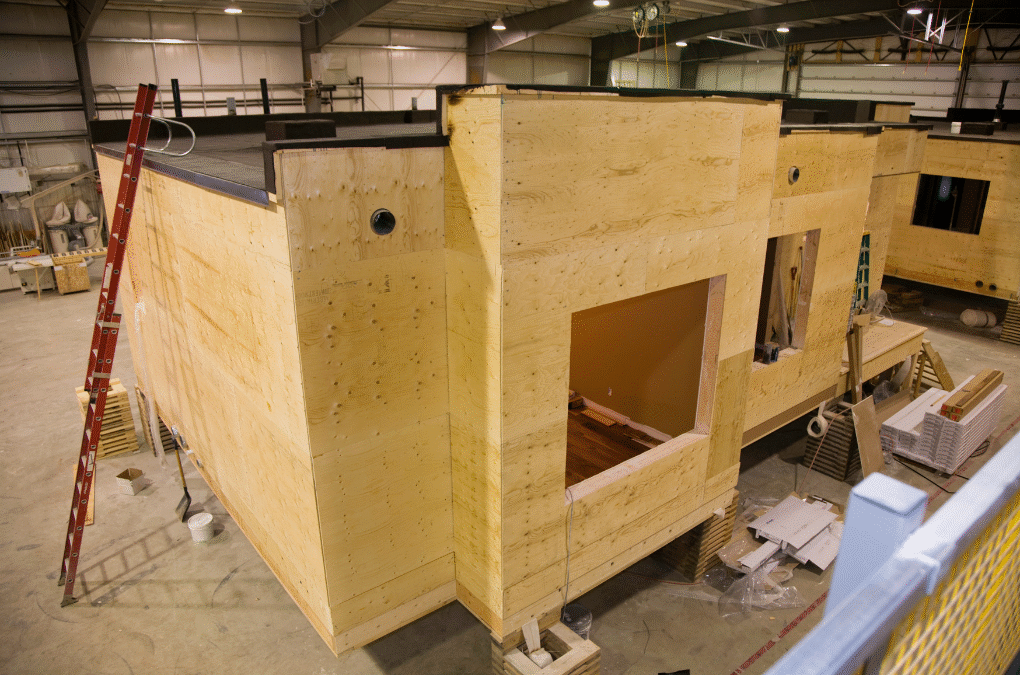

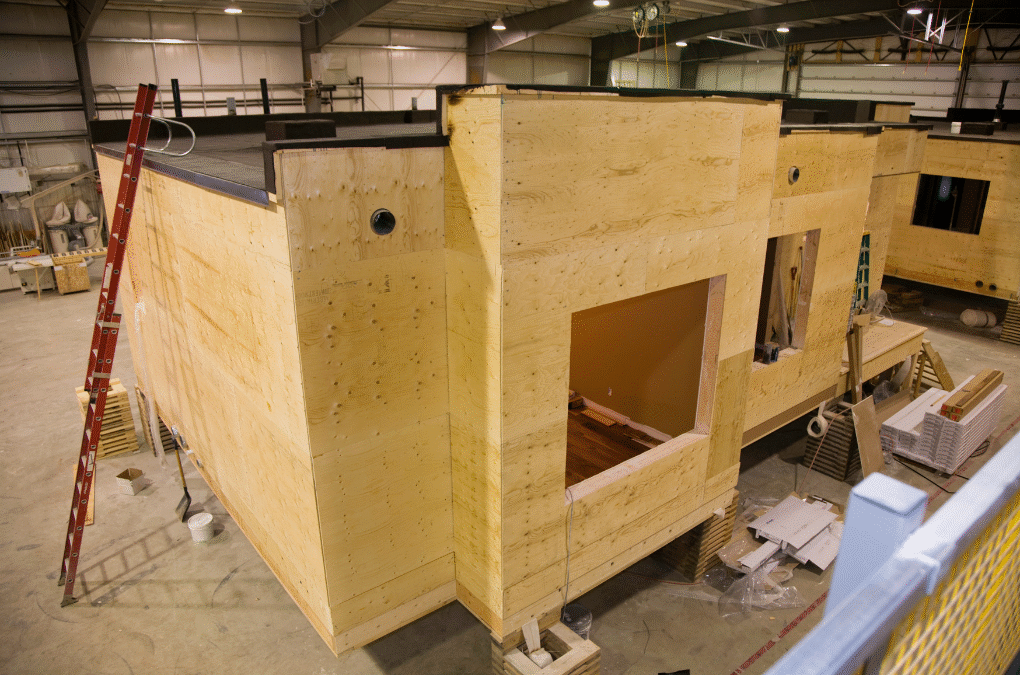

Good news if you’ve been thinking about a modular or prefabricated hom! Getting finance is now much more achievable. Commonwealth Bank has also recently stepped up too to support the prefab housing sector joining the growing list of banks willing to finance these...

by Joy | Sep 2, 2025 | Blog

The popular Home Guarantee Scheme that lets first home buyers get into the market with just a 5% deposit has been expanded sooner than expected. But an unexpected twist means first home buyers may want to bring forward their buying plans. The Home Guarantee...