Unlocking Home Ownership: A Closer Look at the Family Home Guarantee

Owning a home is a dream for many, but for single parents, it can sometimes feel out of reach. The Australian government’s Family Home Guarantee aims to change that narrative, offering a beacon of hope for eligible single parents striving for home ownership. This initiative is a testament to the government’s commitment to making housing in Australia more accessible.

Understanding the Family Home Guarantee

The Family Home Guarantee is a groundbreaking initiative designed to assist single parents in overcoming the often-daunting barrier of hefty deposits. Instead of the traditional 20% deposit, this scheme allows eligible single parents to enter the housing market with as little as a 2% deposit. The government then acts as a guarantor for the remaining amount, ensuring that more families have a place to call home.

Property Market Implications

- Market Accessibility: Discussing how the Family Home Guarantee impacts the ability of single parents to enter the property market and the potential increase in homeownership rates.

- Market Trends: Analyzing how this initiative might influence the demand for certain types of properties, such as family homes and apartments.

- Local Housing Markets: Considering the effects of the Family Home Guarantee on specific regional housing markets.

Financial Considerations and Future Prospects

- Long-Term Financial Benefits: Outlining the potential long-term financial advantages of homeownership through the Family Home Guarantee, including wealth accumulation and equity building.

- Financial Responsibility: Advising on the financial responsibilities associated with homeownership, such as mortgage repayments, property maintenance, and budgeting.

- Future Possibilities: Speculating on the expansion of the Family Home Guarantee program and its potential influence on government housing policies.

Who is Eligible?

Eligibility is centered around supporting single parents, irrespective of whether they are first-time homebuyers or re-entering the housing market. Key criteria include:

- Being a single parent (with at least one dependent child).

- Meeting specific income caps.

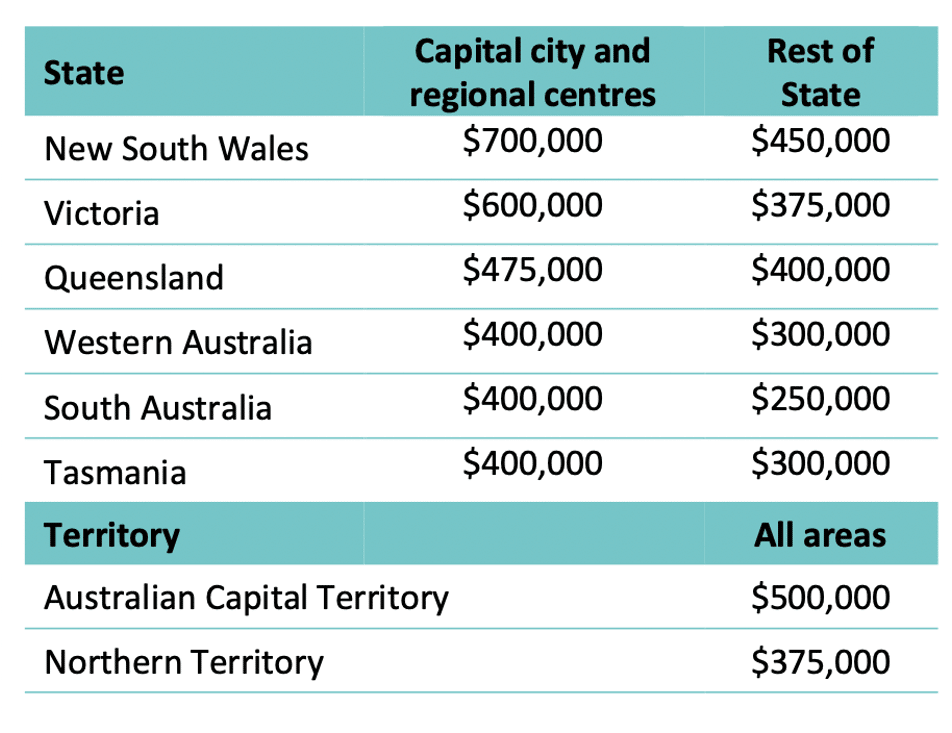

- Purchasing a property that falls within the price threshold specific to the region.

For instance, Jane, a single mother of two in Melbourne, was able to purchase her first home through the Family Home Guarantee, despite having only a modest deposit saved up.

Navigating the Application Process

The application process is straightforward. Begin by checking your eligibility, then approach one of the participating lenders. These lenders will guide you through the application, ensuring you understand every step. Over time, the list of participating lenders has grown, reflecting the program’s success and the financial sector’s trust in it.

Benefits and Considerations

The immediate benefit of the Family Home Guarantee is clear: reduced deposit requirements. This translates to:

- Faster access to the property market.

- Potential savings on rent.

- Building equity in a property sooner.

However, it’s essential to consider the broader financial landscape, including current interest rates and the long-term implications of starting with a smaller deposit.

Success Stories and Program Impact

Since its inception, the Family Home Guarantee has transformed lives. Single parents, once uncertain about their housing future, now find themselves homeowners, building a secure foundation for their families. The ripple effect on the economy is undeniable, with increased property sales and a boost in consumer confidence.

Expert Insights and Tips

Financial advisors and mortgage brokers emphasize the importance of understanding the nuances of the Family Home Guarantee. While it’s a fantastic opportunity, it’s crucial to assess your financial situation and long-term goals. Remember, while the program aids in purchasing, maintaining a home requires a stable income and financial planning.

The Family Home Guarantee is more than just a policy; it’s a commitment to the single parents of Australia. It recognizes the challenges they face and offers a tangible solution. If you’re a single parent dreaming of owning a home, this might be the key to unlocking that dream.

Frequently Asked Questions

What is the Family Home Guarantee?

The Family Home Guarantee is a government initiative designed to assist single parents in entering or re-entering the housing market with a minimal deposit.

Who is eligible for the Family Home Guarantee?

Single parents, regardless of whether they are first-time homebuyers or previous homeowners, can benefit from the Family Home Guarantee, provided they meet specific income and other eligibility criteria.

How does the Family Home Guarantee work?

The program allows eligible single parents to purchase a home with as little as a 2% deposit, with the federal government guaranteeing up to 18% of the loan, reducing the need for Lenders Mortgage Insurance (LMI).

How does the Family Home Guarantee differ from the First Home Loan Deposit Scheme?

While both schemes aim to help Australians achieve homeownership with a reduced deposit, the Family Home Guarantee specifically targets single parents, regardless of their first-time homebuyer status.

How many places are available under the Family Home Guarantee?

The government has allocated a limited number of spots for the Family Home Guarantee, making it essential for interested individuals to apply as soon as they’re ready.

Can I access other government grants or schemes along with the Family Home Guarantee?

Yes, eligible individuals can often combine the Family Home Guarantee with other state and federal homeownership incentives, but it’s essential to check specific eligibility criteria for each.

Phone: 1300 855 022

Zippy Financial is an award-winning mortgage brokerage specialising in home loans, property investment, commercial lending, and vehicle & asset finance. Whether you are looking to buy your first home, refinance or build your property investment portfolio, the team at Zippy Financial can help find and secure the right loan for you and your business.

About the Author:

Louisa Sanghera is an award-winning mortgage broker and Director at Zippy Financial. Louisa founded Zippy Financial with the goal of helping clients grow their wealth through smart property and business financing. Louisa utilises her expert financial knowledge, vision for exceptional customer service and passion for property to help her clients achieve their lifestyle and financial goals. Louisa is an experienced speaker, financial commentator, mortgage broker industry representative and small business advocate.

Connect with Louisa on Linkedin.

Louisa Sanghera is a Credit Representative (437236) of Mortgage Specialists Pty Ltd (Australian Credit Licence No. 387025).

Disclaimer: This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. This article is not to be used in place of professional advice, whether business, health or financial.

RELATED ARTICLES

SERVICE LOCATIONS