How Do You Pay Off Your Mortgage Early?

With interest rates rising so quickly over, everyone is feeling some degree of mortgage pain. We all know that higher interest rates mean higher repayments. So, what are some strategies that can be used to get the mortgage down quicker?

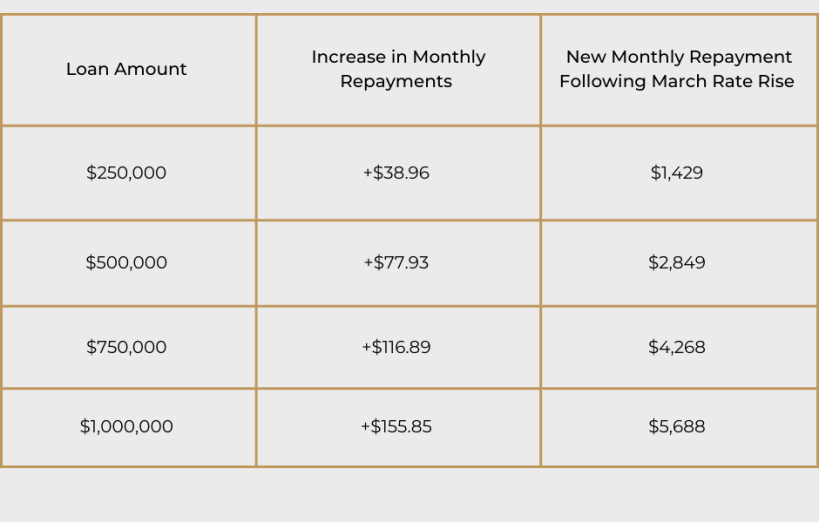

The last RBA rate hike happened in March, bumping up the average principal and interest mortgage as follows:

Based on a 30-year, principal and interest residential loan, assuming an interest rate increase of 0.25% p.a. up to 5.50% p.a. Calculations care of Money Smart’s mortgage calculator.

Ways to Speed Up Mortgage Repayment

Now that there is a guide towards the figures you are working with, here are some ways to pay down a home loan sooner:

Get a Better Job

Moving jobs is often a great time to negotiate a decent pay bump. The current unemployment rate is very low and there are plenty of jobs available, so now could be the time to see what else is out there.

Generate a Second Income

Again, it’s not ideal to have to trade your time for money on top of your main job, but if you can spare a few hours to drive Uber journeys, deliver UberEats or even rent out a room on Airbnb, you could generate a few hundred dollars a week to offset mortgage increases.

Refinance Your Home Loan

Refinancing to a cheaper rate can shave a small fortune off your home loan each month. If you can refinance to a lower rate so your repayment decrease, but you keep the amount you’re paying at the as it is right now, you’ll make extra payments towards the principal, helping you repay the loan sooner. You may even qualify for a cashback loan, which delivers a cash injection of $2,000 – $4,000 directly into your bank account.

If you have a variable home loan with an offset account, you’ll get an even bigger benefit by stashing all your savings in this account. These savings will reduce the amount of interest you pay.

For instance, if you have $50,000 in your offset account and $600,000 loan, you will only pay interest on $550,000. Your monthly repayment stays the same, but the part of the repayment that would have been spent in interest, is put towards your outstanding principal instead.

This allows you to repay greater chunks of the principal each month, helping you repay the loan more quickly.

In fact, I just ran the numbers and on the loan in my example, assuming a principal and interest, $600,000 home loan with a 30-year loan term at 5.5%. With $50,000 worth of savings in the offset account, you could save $172,993 in interest and reduce your loan term by 4 years and 2 months.

Frequently Asked Questions

What are the implications of the recent RBA rate hike on mortgage repayments?

The last RBA rate hike happened in March, which has led to an increase in the average principal and interest mortgage. The article provides a guide on how these figures have been affected.

How can changing jobs help me pay off my mortgage faster?

Changing jobs can often lead to a pay bump. Given the current low unemployment rate, now might be a good time to explore new job opportunities to increase your income and make higher mortgage repayments.

What are some ways to generate a second income to offset mortgage increases?

You can generate a second income by driving for Uber, delivering for UberEats, or renting out a room on Airbnb. These extra earnings can help you offset the increase in mortgage repayments.

How can refinancing my home loan help me pay it off sooner?

Refinancing to a lower rate can reduce your monthly repayments. If you maintain your current repayment amount even after refinancing, you’ll make extra payments towards the principal, helping you repay the loan sooner.

What is the benefit of having an offset account with a variable home loan?

An offset account can reduce the amount of interest you pay on your loan. For example, if you have $50,000 in your offset account and a $600,000 loan, you’ll only pay interest on $550,000. This allows you to repay greater chunks of the principal each month.

How can I get personalized advice on optimizing my home loan?

For personalized advice on optimizing your home loan, you can contact a mortgage broker for a review of your current loan and explore options to pay it off sooner.

Offset accounts are one of the most powerful tools you can use to pay off your mortgage early, but it’s not the only option you have. If you’d like one of our experienced mortgage brokers to undertake a personalised review of your home loan to see what options you must optimise your situation and own your home outright sooner, contact our friendly team today.

Phone: 1300 855 022

Zippy Financial is an award-winning mortgage brokerage specialising in home loans, property investment, commercial lending, and vehicle & asset finance. Whether you are looking to buy your first home, refinance or build your property investment portfolio, the team at Zippy Financial can help find and secure the right loan for you and your business.

About the Author:

Louisa Sanghera is an award-winning mortgage broker and Director at Zippy Financial. Louisa founded Zippy Financial with the goal of helping clients grow their wealth through smart property and business financing. Louisa utilises her expert financial knowledge, vision for exceptional customer service and passion for property to help her clients achieve their lifestyle and financial goals. Louisa is an experienced speaker, financial commentator, mortgage broker industry representative and small business advocate.

Connect with Louisa on Linkedin.

Louisa Sanghera is a Credit Representative (437236) of Mortgage Specialists Pty Ltd (Australian Credit Licence No. 387025).

Disclaimer: This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. This article is not to be used in place of professional advice, whether business, health or financial.

RELATED ARTICLES

SERVICE LOCATIONS